Wondering where retailers will get content to drive their 3D printing services? As I’ve mentioned previously, content would likely come from at least three sources. Retailers could crowdsource content directly from designers, animators, engineers, inventors, and makers. 3D scanning is also likely to be a source. In fact, with the advancements being made every day on that front, it seems possible that soon 3D scanners could be as ubiquitous as smartphone cameras. Still another opportunity is content originating from the manufacturers and consumer packaged goods companies who supply retailers today. Maybe it’s time for them to think outside the container?

My last series of articles was centered on the types of retailers who could successfully offer 3D printing as a service. Now I’m switching gears and focusing on the manufacturers who could supply hundreds or even thousands of new, digital products retailers could offer online and in-store.

Newell Rubbermaid has a long history in household products. The company was formed in the early 1900’s and supplied curtain rods to retail giants like Woolworth and Kresge (what later became Kmart.) By the 1960’s it had amassed several companies and grown to over 70 brands, becoming a powerhouse in the housewares and hardware categories, serving many national retail brands. In the 1990’s it went on an acquisition spree, buying big names in office supplies, cookware, and personal care. Its biggest acquisition came in 1999, when it purchased Rubbermaid. The deal also included brands like Graco and Little Tikes, and in aggregate, doubled the size of the company. Since then, the company has gone on to acquire other brands in writing instruments, tools, and label making among others.

In 2012, Newell Rubbermaid announced its Growth Game Plan, a strategy to “accelerate into a larger, faster growing, more global and more profitable company.” Key planks in the strategy include helping its consumer brands “win at the point of decision through excellence in

performance, design and innovation” and “helping its professional brands win the loyalty of the chooser by improving the productivity and performance of the user.” The plan also calls for the company to “collaborate with our supplier and customer partners across the total enterprise in a shared commitment to growth and creating value.” It also places emphasis on expanding beyond the company’s current borders, building “a more global perspective and talent base.”

Could 3D printing be a tactic to help Newell Rubbermaid reach its goals? It certainly checks the innovation box. It could also go a long way towards helping improve productivity, more easily making the right product available at the right place and time. Offering products in digital format and taking a leadership role in helping retailers develop a massive catalog of digital content would be a prime example of collaboration and has the potential to create significant value for both parties. Finally, as other content platforms have proven, digital knows no boundaries. If the company wants to go global, 3D printing could allow its products to reach the far corners of the earth without the logistical concerns that plague mass-production.

Product Opportunities

I’m sure the burning question for many of you is, “What kinds of products?” Let’s take a deeper look into the brands that make up Newell Rubbermaid.

Storage

When you think Rubbermaid, you probably think containers. While they do offer an amazing assortment, they offer many other products as well. From bathroom accessories like brushes, squeegees and plungers, to car accessories like cup holder organizers and from closets and shelving to garage organizers and storage sheds, the firm’s Rubbermaid brand offers an insane number of products. Walmart carries nearly 3,500 Rubbermaid products on its website. A search on HomeDepot.com returned over 225 products and Target.com nearly 120. In contrast, a search at Amazon.com returned over 43,000 products. Now, its likely that not all are unique, but many are. Some percentage of those products, accessories, and parts could be 3D printed, cost competitively, in-store.

Office Supplies

Newell Rubbermaid has cornered the market on writing instruments. They own Sharpie, Paper Mate, Parker and Waterman, among others. You might wonder why anyone would 3D print a pen when they are so cheap to mass manufacture. People love unique writing instruments and 3D printing would allow the company to offer a nearly unlimited number of designs. Further, it would feed their refill business. A search at OfficeDepot.com return over 300 results for pen refills. Its a big business.

Also, consider the replacement part market. I own a Waterman pen and a long time ago broke the plastic end cap. At one point I inquired about fixing it and the cost to ship it was considerably more than the part itself. And, don’t forget about the collectible pen market. The market for old fountain pens from Parker, Waterman and others is significant. I have a friend whose collection is easily worth six figures. Finding replacement parts can be difficult and expensive, if not impossible. 3D scanning and printing could be be a huge opportunity there.

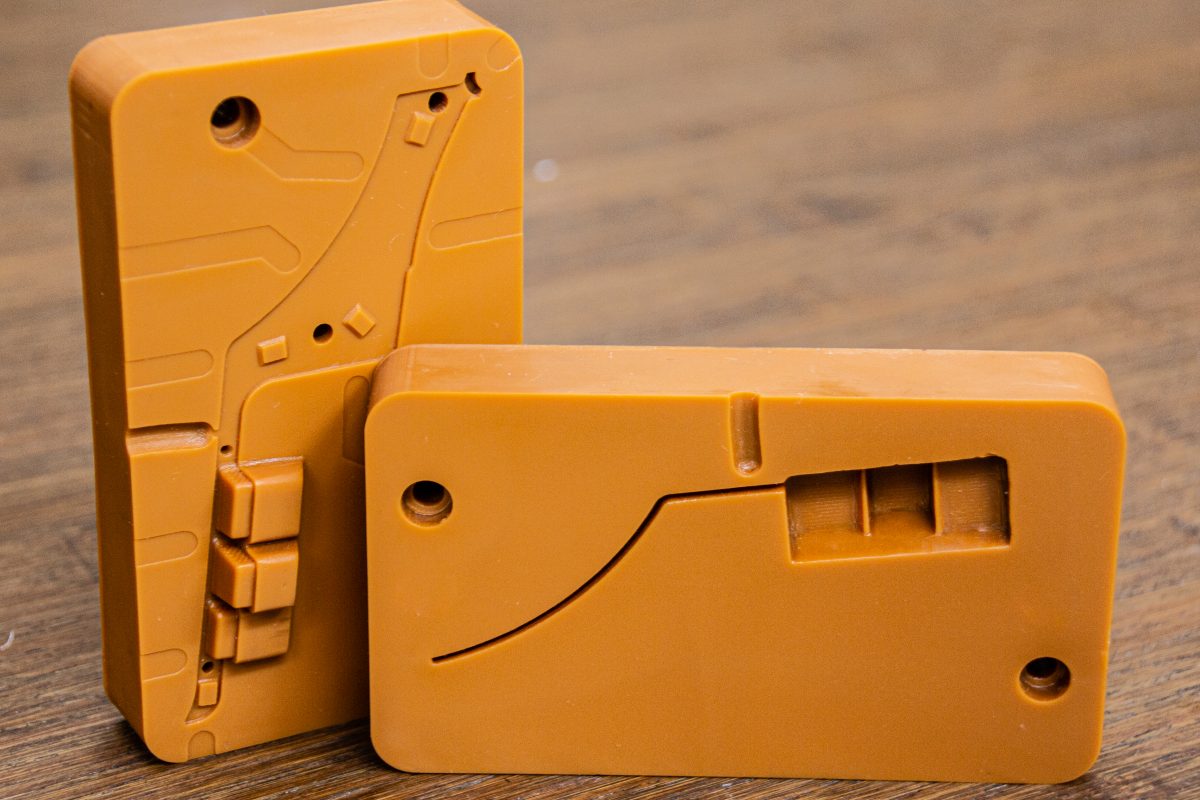

Beyond pens, Newell Rubbermaid also owns office brands like Dymo and Rolodex. Many of the replacement parts for Dymo label makers could be 3D printed. When you think Rolodex, you probably think business card holders. They’ve moved way beyond, offering a complete line of desktop accessories, including organizers and laptop stands. It would seem a natural extension for them to offer smart device accessories like stands and cases. Given the huge variance in product specifications and size, these are a slam dunk for 3D printing.

Baby

If there’s an area where Newell Rubbermaid has gone global its in baby care. The company’s Graco brand sells swings, highchairs, playards, strollers, and car seats, primarily servicing customers in North America. The company’s Aprica brand offers similar products in Asia and its Teutonia brand covers Europe. While there might be safety and legal concerns around 3D printing many of the products and replacement parts in this category, there are certainly others that could be a fit.

Personal Care

Did you know Newell Rubbermaid owns Goody? I didn’t either, but its what got me started down this path. I have two daughters (ages 13 and 14) and it seems they spend more time arguing over hair accessories than anything else. From hair brushes and clips, to straight irons and blow dryers, its a pretty constant source of drama around here.

I was recently interviewed for an article that will soon be appearing in Drug Store News. The interviewer asked me what kind of 3D printed products a pharmacy might offer. We talked at length about prosthetics and medical devices, but I also made the point that pharmacies like Walgreens and CVS offer much more. They’re mass merchandisers now, offering everything from kitchen wares to auto accessories and toys.

Then I went back to my research on Walmart. I recalled noting the breakdown of their sales by category. Here were some of the top sellers:

Personal care (14.5% of sales)

Storage / organization (8% of sales)

Kitchen appliances (7% of sales)

Baby (4% of sales)

All are markets for Newell Rubbermaid and personal care is one of the biggest. Why couldn’t many of the products and accessories offered by Goody, Solano (hair dryers and curling irons), and Ace, (its mens care line) be 3D printed? Talk about engagement! Take it from a father of two, girls my daughters age would have their parents lining up for 3D printed hair accessories which they could watch being made, driving even more in-store time (and spend.)

Housewares Tools and Hardware

Beyond these products, Newell Rubbermaid has plenty of other opportunities. From kitchen tools sourced from its Calphalon brand, to window blind accessories and parts from Levolor and Kirsch, and tools from Irwin, Lenox, and Hilmor, each brand has at least some products which could be 3D printed.

Why Partner with Retailers?

With this much opportunity, you might ask why a company like Newell Rubbermaid should even bother partnering with retailers. Why would it not simply offer products as digital format on its own websites? First, they don’t generate nearly as much traffic as a retailer’s website and there would be considerable cost in generating awareness. Due to competition with online retailers like Amazon, retailers have invested heavily in eCommerce, building sophisticated systems supported by sizable IT staff. They’re closer to ready.

Also, local manufacturing maximizes the benefits of 3D printing. It eliminates much of the cost associated with packaging, shipping, and fulfillment. Retailers with brick-and-mortar, could print in-store.

Further, while digital manufacturing has the potential to be a boon for Newell Rubbermaid, the vast majority of its products are already sold in retail stores. The company would want to be careful not to cannibalize its sales there. Working with retailers, the company could gain access to sales data which would help it make better decisions about which products to mass manufacture and where to stock them. In this way, digital manufacturing can complement (versus competing with) mass production.

Finally, deepening its partnership with retailers could help Newell Rubbermaid more effectively cross-sell its products. CEO, Michael Polk recently stated in an AJC interview that, “We were sell writing instruments in Home Depot. We also sell power tool accessories, commercial products for cleaning and containers for storage. All those things cut across the retail channel. But each business unit had its own sales force, its own finance and HR functions. Too much of our costs was tied up in that infrastructure and not enough was tied up in the brands.” Helping retailers sell its products in digital format would encourage a more holistic approach, and likely improve exposure and placement of its “win bigger” brand categories.

For retailers it’s an extension of a timeless strategy. Find great suppliers and leverage their innovation and brand recognition to sell great products to their customers. But now, some of those products could be stocked digitally and sold on demand.