For 3D printing to go beyond prototyping and make real money from end-use part production, large-scale digital manufacturing networks will need to be constructed. Once the infrastructure is in place, blockchain could play a big role in helping protect intellectual property and manage licensing and payment. But if used strategically, the cryptocurrencies enabled by blockchain could also provide a new source of funding, putting more capacity in the right places, faster.

Recently Kodak announced a major blockchain initiative. Their idea is to use digital ledgers to help photographers manage usage rights and get paid for their work. Central to the plan are KODAKOne which will serve as an image rights management platform and KODAKCoin, a new cryptocurrency that will uniquely serve the photography profession.

Kodak’s stock nearly tripled after the announcement, raising their market value by over $150 million. But according to the company’s CEO, Jeff Clarke, this wasn’t just a gimmick to pump life into Kodak’s ailing stock. In the press release, Mr. Clarke noted that photographers have “long struggled to assert control over their work and how it’s used,” adding that terms like cryptocurrency aren’t just buzzwords, they “are the keys to solving what felt like an unsolvable problem.”

No matter how you cut it, blockchain is a buzzword and one that is creating short-term value for companies in many different industries. One extreme example is Biopix, which started out as an animal healthcare company, licensing and selling hormone solutions for the farm and livestock industries. In a pretty extreme pivot, the company was renamed RIOT Blockchain and changed its focus to become a strategic investor and operator in the blockchain ecosystem. In September, 2017 it was a $4 stock. By mid-December it topped $38 per share. It has since settled back down, trading today at under $17.

Other examples are also easy to find. Long Island Ice Tea Company changed its name to Long Blockchain Corp and poof, its stock jumped nearly 3x, from $2 per share to over $6. Also, Hooters parent company, Chanticleer Holdings Inc., announced it would use cryptocurrency for its loyalty program and saw a sharp increase in stock value. Some have even (jokingly) suggested that IBM officially add blockchain to their company name.

Blockchain & 3D Printing

What does any of this have to do with 3D printing? Well for starters I can think of a few companies in this industry that could benefit from a spike in their stock price. Maybe go with 3D Blockchain Systems or Stratasys Cryptocurrency?

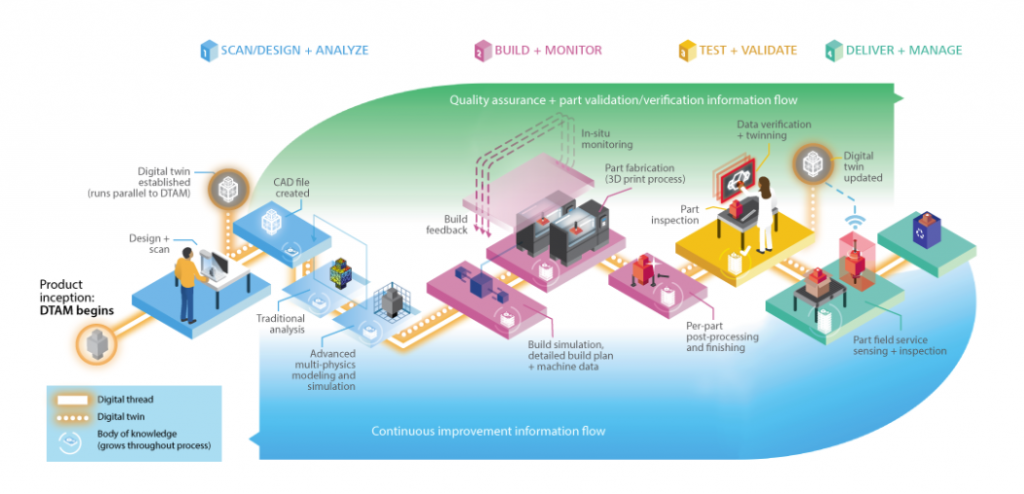

On a more serious note, blockchain and the cryptocurrencies it enables, do create some big opportunities for the 3D printing industry. In fact Deliotte envisions use cases for blockchain throughout the product lifecycle. They refer to it as the “digital thread for additive manufacturing:”

IP Rights Management

In short, here’s how blockchain works. It provides a digital, distributed ledger that is fully documentable and attributable. Entries are permanent, transparent and searchable. Each new entry serves as a new “block” in the chain. With cryptocurrencies like Bitcoin and Ethereum, it serves as the data and security layer.

As the Kodak announcement alluded to, it can also play an important role in the management of intellectual property. Just like photographers, product designers also struggle with controlling the use of their work and ensuring they are fairly paid. In the past they would file for copyright, trademark and patent protection. When competitive offerings violated their IP, they had a choice to make. Allow it to happen, or use the legal means at their disposal to stop it.

Usually that decision was based on the size of the infringement and the amount of publicity it generated. Sending a “cease and desist” letter is easy. Suing someone to get injunctive relief and damages is a much more expensive proposition. Most people and companies won’t do it unless they see a potential return on that investment. Legal action against another company or a wealthy individual makes sense. They can pay.

But with 3D printing, the barrier to entry is so much smaller. Individuals all over the globe have become “makers.” In that environment, IP rights management and enforcement becomes much more difficult. As manufacturing becomes further democratized, the challenges are likely to escalate.

Blockchain can help in several ways. First it can provide designers with tamper-proof evidence of ownership. Once the design is registered to a blockchain, that information cannot be removed or changed. In theory, third parties, like service bureaus and retailers could see the complete chain of ownership of a work, including any licensing information.

It could also help in the patent process. In most countries, the rights to an invention typically belong initially to the first person to file a patent (“first-to-file system”). The best way to do this is in the U.S. is through an initial patent application. In Europe and elsewhere, ideas are typically registered with a notary. If you’re creating new inventions or code frequently, submitting every idea these entities can be impractical and expensive. Blockchain could provide an irrefutable way for inventors to document the date of their innovations, with far less time and cost.

Licensing & Payment

Further, blockchain could support licensing agreements and payment. The technology already provides for smart contracts, which are agreements that can be automatically facilitated, executed and enforced. The terms are defined in advance, allowing parties to do business without administrative burden or unnecessary cost. In the case of 3D printing, that could mean licenses that are executed immediately whenever a design file is viewed, edited or manufactured.

It can also be used to manage financial transactions. Consider Kodak for a moment. What they’ve really announced is an Initial Coin Offering (ICO). ICO’s started out as an unregulated way to raise capital for new cryptocurrencies, but now they’re also being used to fund other ventures. In Kodak’s case, it’s even more complex. They won’t receive any of the proceeds of the ICO, but they will create and benefit from a new market worth somewhere between $20 and $100 million. A company in their position could generate significant revenue for example, by charging transaction fees and serving as a currency exchange.

It can also be used to manage financial transactions. Consider Kodak for a moment. What they’ve really announced is an Initial Coin Offering (ICO). ICO’s started out as an unregulated way to raise capital for new cryptocurrencies, but now they’re also being used to fund other ventures. In Kodak’s case, it’s even more complex. They won’t receive any of the proceeds of the ICO, but they will create and benefit from a new market worth somewhere between $20 and $100 million. A company in their position could generate significant revenue for example, by charging transaction fees and serving as a currency exchange.

It’s not just established companies. Startups are also getting in on the act. Sirin Labs recently raised over $150 million with an ICO. Guess what they’re going to make? A smartphone with special features for cryptocurrency enthusiasts. The company says the product will fill a need in a fast-growing market: a secure device that can simplify the use of blockchain technology across multiple applications.

It makes my head spin.

3D-Token

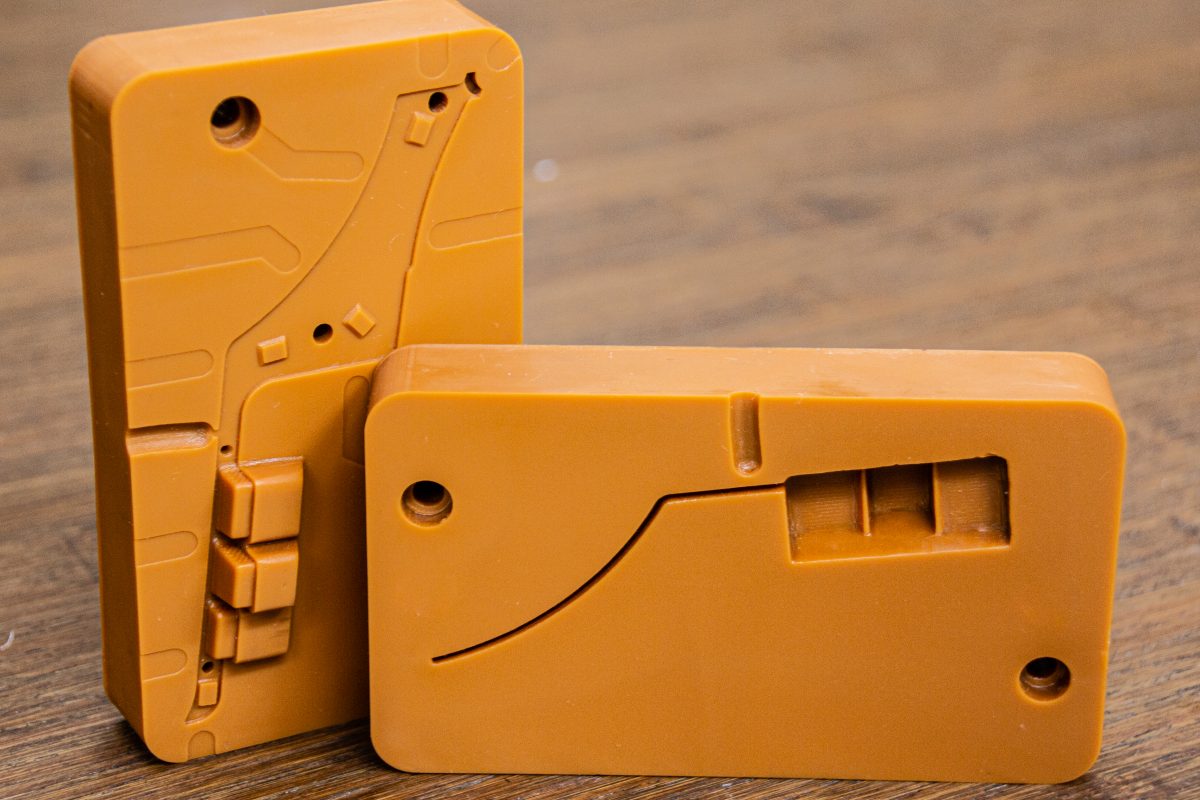

Sirin isn’t the only startup trying to leverage cryptocurrency to raise funds and build out their business model. One example in the 3D printing industry is 3D-Token. They created an ICO to build a blockchain-based network of 3D printers. The goal is to have over 1,000 nodes and 3,000 3D printers on their network, giving their “Network Robots Workforce” a capacity of 22 million hours of production time and the ability to output over 300 tons of workable bioplastics annually.

Of course, in addition to serving as a form of currency exchange, 3D-Token plans to use the coins issued as part of their ICO as a form of payment on their network. Their Marketplace / Crowdfunding online platform will allow 3D-Token holders to “exchange their tokens peer-to-peer,” to buy capacity from the Network Workforce in order to complete print projects, and “participate in other crowdfunded projects” related to the 3D manufacturing world. Hmmm.

Moog

Moog Inc. is a worldwide designer, manufacturer, and integrator of precision control components and systems. The company is entrenched in several vertical markets, including aerospace, vehicles, marine, industrial machinery, alternative energy and medical equipment.

Moog is both a consumer and supplier of additive manufacturing. Through their long-term involvement with additive technologies, they’ve seen first-hand the power of a digital workflow. Moog recently announced plans to capitalize by building out their own digital manufacturing network.

In their view these kinds of networks have the potential to support:

- High quality rapid prototypes

- Entrepreneurs and start-ups with limited capital access

- Customized/tailored goods, “quantity of one” production runs

- Spare parts that can be printed by end users on-demand at the point of use and time of need to reduce inventory and improve availability (a powerful new option for supporting in-service platforms)

But Moog also recognizes several challenges to digitizing the manufacturing of physical products, including technology, engineering, and data management issues, in addition to other business impacts, like regulation, intellectual property protection and licensing.

Moog’s answer is to build a solution for digital-enabled parts. The system, called MOOG VeriPart® promises to provide secure, authentic parts for distributed supply chains. Based on blockchain technology, it will offer provenance and traceability, using a digital ledger to provide history, secure transport, and authenticity of digital part designs.

Moog says it has “made a deliberate business decision to be part of the disruption caused by 3D printing and blockchain versus being disrupted by them.” The firm “realized the greatest impact our business was going to be how these technologies upended the business models and supply chains employed by manufacturers today.”

More Chicken & Egg

I’ve written about this so much that I think I’m starting to moult. In this case, the chicken & egg are production capacity and asset management.

Obviously, a lot of different companies recognize the potential of blockchain in protecting intellectual property and managing payment, not to mention new revenue opportunities with cryptocurrency. But with 3D printing, that requires a production network that can operate at scale.

3D-Token and Moog both seem to understand this issue. 3D-Token is trying to tackle both problems simultaneously, by using an ICO to build both capacity and a more secure workflow. It seems like Moog is stacking blockchain on top of their existing production system.

While Moog is more focused on the industrial sector, 3D-Token appears to have their sights set on new product development. Both are attractive markets, but if McKinsey is correct and 5-10% of all consumer products (in applicable categories) are eventually 3D printed, they will account for over $500 billion in annual economic impact. That’s a big vein of gold that so far, no one is prepared to strike.

At the recent Inside 3D Printing conference in San Diego, I spoke on the topic of emerging technology, and specifically how new innovations like artificial intelligence and virtual reality will combine with 3D printing and other advanced manufacturing tools to change the way we make things. At the end, someone asked about the impact blockchain might have.

My answer was that blockchain is likely to play a big role in how assets are managed and might even be the future of payment. However, the bigger challenge is in building out a network of capabilities that can allow brands to produce what is needed, when and where it is needed, at scale.

I also reiterated my stance that successful networks will utilize production equipment, not a daisy chain of small desktop printers. The 2D printing industry proved that well enough.

Building a big-ass production network is a multi-million dollar play where return on investment is probably years or even decades away. Figuring out how to solve that dilemma seems like the highest priority. In the consumer segment at least, securing intellectual property and managing payment doesn’t seem very enticing if a brand can’t generate enough product sales to justify the all the pain that accompanies digital transformation.

Blockchain To The Rescue?

Maybe that’s another area where blockchain can benefit? Back in September, Forbes reported that so far in 2017, total investment in blockchain exceeded $4.5 billion, including the sale of $2 billion worth of coins or tokens. In 2016 by contrast, $256 million worth of tokens were sold. With that kind of growth, significant capital is being generated.

Perhaps manufacturers, brands and retailers will figure out how to leverage ICO’s to build out large digital manufacturing systems?

Raising cash is only part of the answer. Companies must also be able to execute in a highly fluid environment. Building a large-scale digital manufacturing network at this point in the technology curve requires an architecture that anticipates continued innovation. People, processes, and technology must be identified and incorporated into the system. They’re all likely to morph over time. In a scenario like that, where disruption is nearly constant, a culture must be in place that not only accepts, but actively embraces change.

In my experience, that excludes many existing brands and retailers. They talk a good game, but have been blindsided by nearly every new technology, from eCommerce, to mobile and more.

Eventually 3D printing will profoundly change how products are manufactured and sold. Companies who wish to compete in that new reality need to focus less on buzzwords and more on building out their networks. In the past, he or she who owned the data, owned the customer. If social media has taught us anything it’s that nowadays, he or she who owns the platform, owns everything.